Pending home sales point to softer market

Don Fenley

GRAY, TN – Pending sales and NETAR’s Pending Sales Index point to a weaker market during what is typically the busiest months of the year.

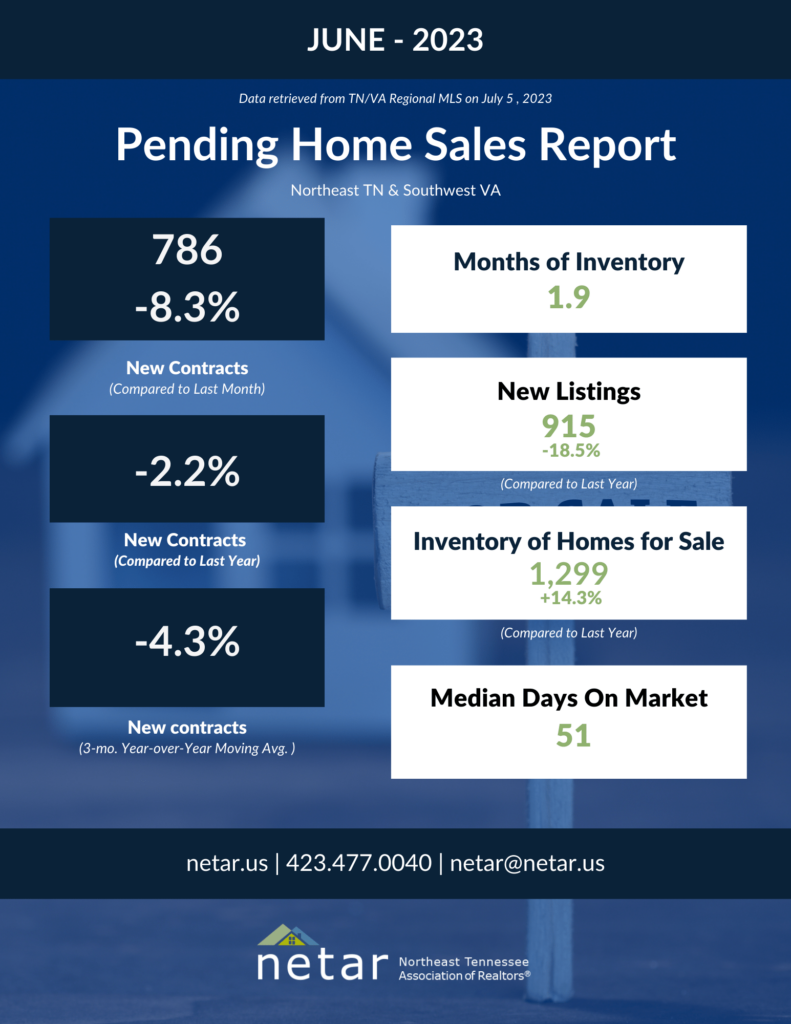

June’s pending home sales pace declined 8.3% from April and fell 2.2% from June last year. Pending sales represent homes that have a signed purchase contract but have not closed. They lead existing home sales data by one to two months.

And June’s NETAR Pending Sales Index dropped to 120 – down 10 points – from June last year. The index is a forward-looking indicator based on the 2018 annual average for signed contracts to buy a home rather than the final sales that are accounted for in the Home Sales Report. An index of 100 is equal to the pre-pandemic accepted contracts level. An index of more than 100 is the percentage increase, below 100 is a decline.

New listings – down 18.5% – and median days on the market also signal softer conditions and less demand as the market closes out the summer season. The days on market increased to 51 last month. This time last year it was 44. NETAR’s days on market begin when a listing goes public and rolls off when the sale is closed.

Declining demand isn’t phasing sellers. The median listing price has increased every month this year and is at an all-time high of $330,000. At the same time, 52% of June sales were discounted by an average of $10,000 per sale. So, what’s effectively happening is sellers are increasing the asking price for wiggle room during the negotiations.

At mid-month, the median sales price increased to $267,500, up 11.5% from last year. That’s an all-time high. The median sales price marks the middle point where half of the sales were for more and half for less. The average sales price was $312,445, up 11.6% from last year.

There were 207 pending sales in the affordable homes market last month, down 12.3% from last year.

Opposite conditions exist for new contracts in the move-up market. They totaled 346, up 16.9% from last year. The largest increase was in the $400K-$499,999K price range. They increased 24.6%.

New contracts in the luxury market were down 2.2% after a 13-closings surge of $1 million and above price range sales.

Pending home sales point to weaker market

GRAY, TN – Pending sales and NETAR’s Pending Sales Index point to a weaker market during what is typically the busiest months of the year.

June’s pending home sales pace declined 8.3% from May and fell 2.2% from June last year. Pending sales represent homes that have a signed purchase contract but have not closed. They lead existing home sales data by one to two months.

And June’s NETAR Pending Sales Index dropped to 120 – down 10 points – from June last year. The index is a forward-looking indicator based on the 2018 annual average for signed contracts to buy a home rather than the final sales that are accounted for in the Home Sales Report. An index of 100 is equal to the pre-pandemic accepted contracts level. An index of more than 100 is the percentage increase, below 100 is a decline.

New listings – down 18.5% – and median days on the market also signal softer conditions and less demand as the market closes out the summer season. The days on market increased to 51 last month. This time last year it was 44. NETAR’s days on market begin when a listing goes public and rolls off when the sale is closed.

Declining demand isn’t phasing sellers. The median listing price has increased every month this year and is at an all-time high of $330,000. At the same time, 52% of June sales were discounted by an average of $10,000 per sale. So, what’s effectively happening is sellers are increasing the asking price for wiggle room during the negotiations.

At mid-month, the median sales price increased to $267,500, up 11.5% from last year. That’s an all-time high. The median sales price marks the middle point where half of the sales were for more and half for less. The average sales price was $312,445, up 11.6% from last year.

There were 207 pending sales in the affordable homes market last month, down 12.3% from last year.

Opposite conditions exist for new contracts in the move-up market. They totaled 346, up 16.9% from last year. The largest increase was in the $400K-$499,999K price range. They increased 24.6%.

New contracts in the luxury market were down 2.2% after a 13-closings surge of $1 million and above price range sales.

NETAR is the voice for real estate in Northeast Tennessee. It is the largest trade association in the Northeast Tennessee, Southwest Virginia region, representing over 1,800+ members and 100+ business partners involved in all aspects of the residential and commercial real estate industries. Weekly market reports and information for both consumers and members are available on the NETAR website at https://netar.us