Sept. home sales continue decline, prices stable

Don Fenley

The local housing market stayed fast with the trend of fewer sales and price stability in September. It was also a month with outliers rendering some eye-popping monthly price numbers. Overall, prices made a small monthly increase while sales dipping 18 percent and closer to the 2018 pre-pandemic level.

“The sales decline was expected. Rates are at a 23-year high and since so much of the home buying is based on the monthly payment, the numbers are understandable. Lenders are also tightening qualifications,” said Jan Stapleton, president of the Northeast Tennessee Association of Realtors (NETAR). “Sales in the $400K to $499,999 range were the only move-up increase last month – eight better than last year. Sales in the $500K and above Luxury market were up by 11.”

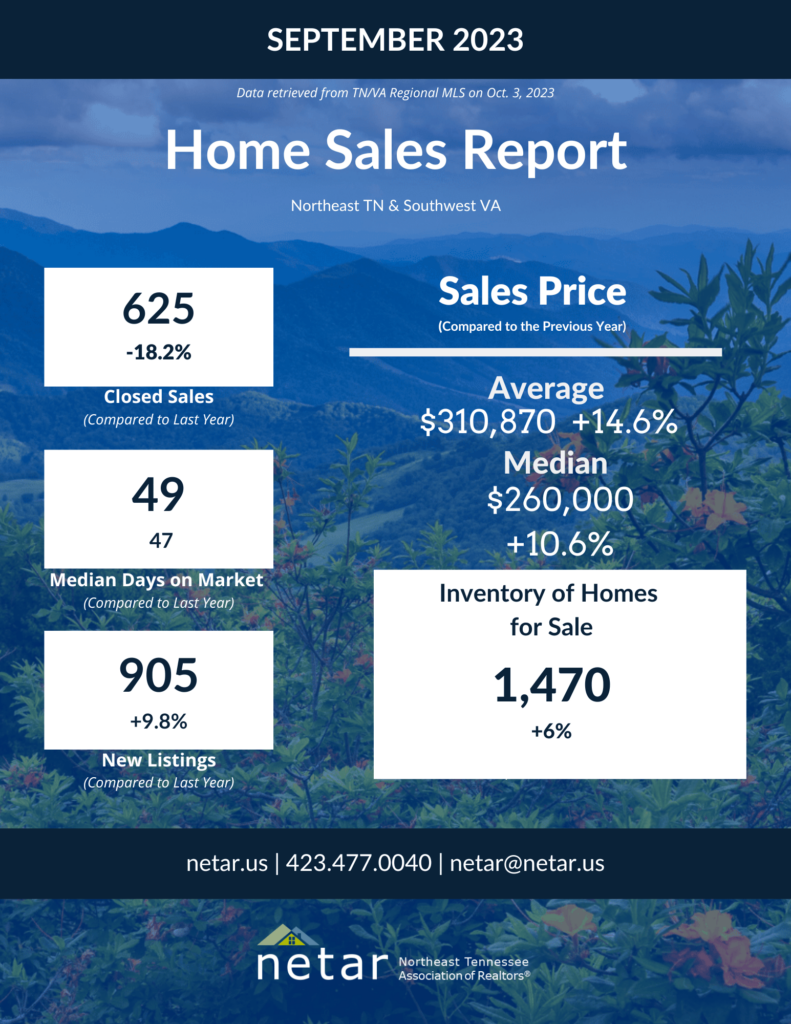

There were 625 closings in NETAR’s early September sales count, down 101 from the August total and 139 fewer than September last year. The sales number typically increase with the mid-month update when closing reported too late for the first-of-the-month count are included.

September’s median sales price was $260,000, up $350 from August and 11 percent higher than last year. The median is the point where half of the homes sold for more and half sold for less. September’s average sales price was $310,870. It was $271,204 last year.

Last month sales in the affordable market were down 23 percent from last year.

The move-up market’s three price ranges are where most activity occurs. Overall sales in that sector were down 14 percent from last year. The only improvement was those $400K-$499,999 range. They were up by eight sales.

There were 68 luxury home sales – 11 more than last year.

Demand – as measured by the time a property sits on the market before closing – increased to 49 days from 47. An increase in time on market signals less demand. NETAR calculates the days on the market from the day a property is listed until it closes. Many of September’s sales were going from listing to accepted contract two weeks or less.

Sellers reduced their asking price on 51 percent of last month’s sales. The average discount was $19,743. August’s average discount was $17,237. This is one area zinged by the outlier effect. The most common discount was $5,000.

Active listings grew by 54 from August, barely boosting the region to 2.3 months of inventory.

There were 460 new construction single-family homes, townhomes and condos listed in early Oct. During the same period in September there were 340.

Most county and community submarkets market conditions follow the regional pattern of fewer sales and higher prices.

A full listing for July’s regional, county and community sales and prices analytics can be found on the NETAR website at https://netar.us/september-2023-market-analytics/

NETAR is the voice for real estate in Northeast Tennessee. It is the largest trade association in the Northeast Tennessee, Southwest Virginia region, representing over 1,800+ members and 100+ business partners involved in all aspects of the residential and commercial real estate industries. Weekly market reports and information for both consumers and members are available on the NETAR website at https://netar.us