2024 housing market keywords – inventory, inventory, inventory

Michelle Davis - 2024 NETAR President

If you want to get an edge on what this year’s housing market will look like as we head into the prime season – and beyond – the metric that stands out is the relationship between pending sales and active inventory.

NETAR President

Association Spokesperson

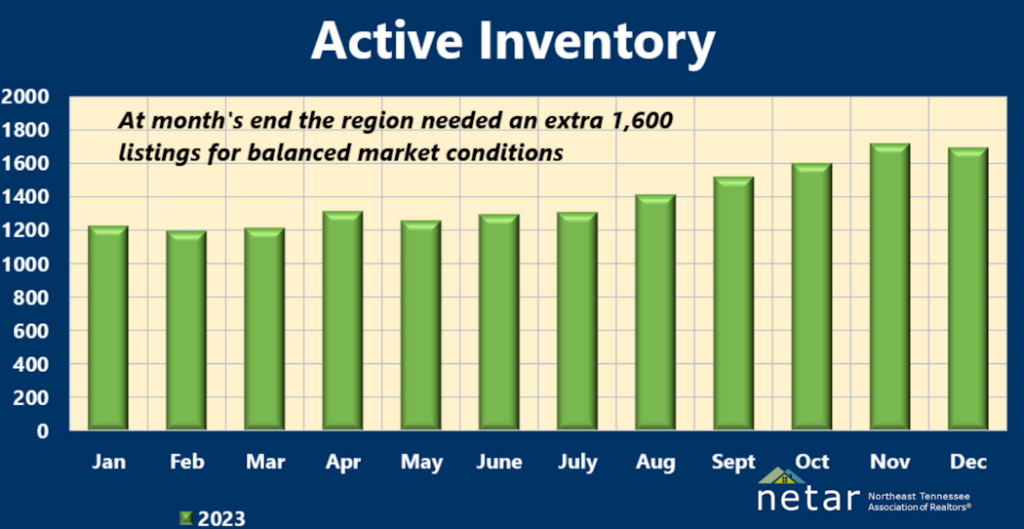

Sales have stabilized to a pre-pandemic level and the price growth rate has slowed. It looks like a good starting point for the housing revival forecasters are talking about. Here’s the baseline. Current inventory is 58% below its 2018 pre-pandemic level – the last period for local balanced market conditions. Another way to look at it is: We have a little less than two months of inventory on the market. That’s how long it would take to sell everything listed at December’s sales pace.

Active inventory is slowly increasing, but the big question is how the demand side will behave. Two primary moving parts behind an answer are:

- How will mortgage rates move the market? It’s accepted rates will move lower, but how low and where they will stabilize? The current average for a 30-year fixed-rate mortgage is trudging toward the 6% to 6.5% target. If that sticks, it could bring 10,000 locals back to the market, according to National Association of Realtors® (NAR) research.

- The second part is demographics. Millennials are well into their prime home-buying years, and the eldest GenZers on the threshold. Combined, they make up the largest share of the Tri-Cities population. And their numbers represent a lot of pent-up demand. The downside is affordability and the number of starter homes. Lower mortgage rates will ease some of the affordability bite since it will lower monthly house payments.

The inventory situation at the end of December offers some – but not a lot – of relief. There were 1,687 single-family and condo active listings on the market. It needed another 1,600 listings to be at the bottom level for balanced conditions. While that’s not especially encouraging, the active illustrated by the active inventory – pending sales relationship offers a better picture.

Early last year, local market watchers began tracking a very slow increase in active inventory as a sign that natural market forces would take some of the crazy out of real estate. It began when new listing outnumbered pending sales in February and continued until stalling in December. It signaled a market dynamic where active inventory was slowly increasing because demand was low enough to slow sales but high enough to sustain price growth.

Lack of inventory isn’t just a NE Tenn. – SW Va. challenge. It’s especially true for markets that saw too little new home construction in the wake of the housing crash during the Great Recession.

Locally, new home construction peaked in 2005. Although builders have ramped up to meet demand, the new home industry – as measured by new home permits – is not performing at the peak performance level. That doesn’t mean developments are anemic. They can be seen area wide, and the momentum seems to be expanding. New projects are underway in Bristol, a market that has been underperforming. And Elizabethton’s first single-family subdivision in two decades is halfway completed.

Tracking this year’s active inventory, pending sales v. new listings ratios and other metrics that identify trends and market niches trumps anything that mass media pundits have to say about what’s happening in the region’s housing market. And the best source for that local knowledge is NETAR’s monthly and weekly market reports and the local Realtors® who keep their fingers on the market’s pulse.

NETAR is the voice for real estate in Northeast Tennessee. It is the largest trade association in the Northeast Tennessee, Southwest Virginia region, representing over 1,800+ members and 100+ business partners involved in all aspects of the residential and commercial real estate industries. Weekly market reports and information for both consumers and members are available on the NETAR website at https://netar.us