Commercial Real Estate Inventory Perks Up, Transactions at 3-Year Low

Don Fenley

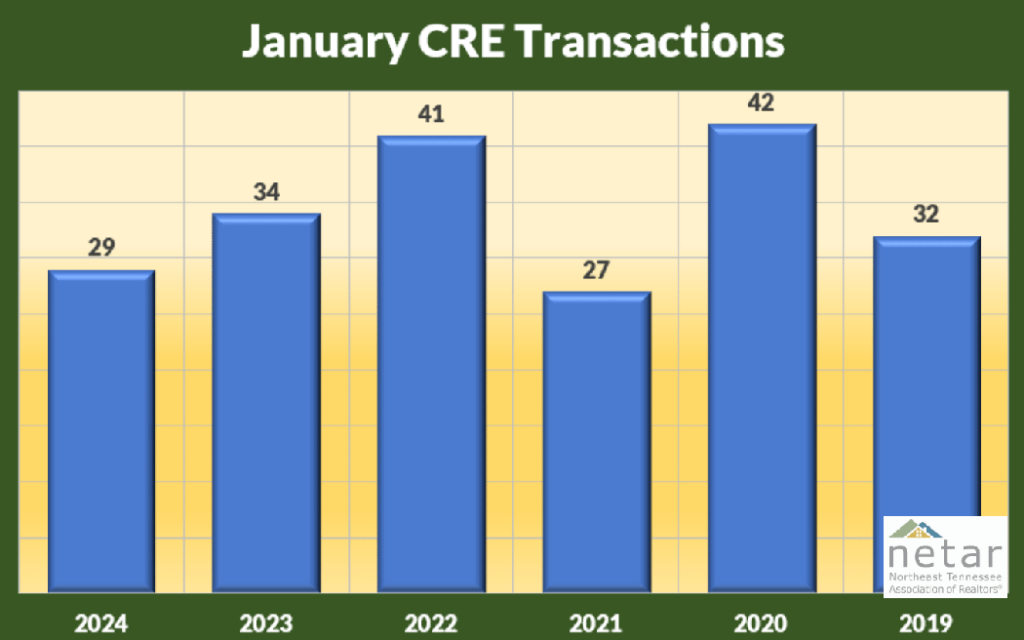

There was a sign of new life in the local commercial real estate (CRE) market last month. Inventory and new listings increased while total sales and lease transactions dropped to a three-year low.

Last year’s top performing sectors – multifamily, office and retail, saw mixed monthly performance. There were four more multifamily and five more retail transactions than last year, but the office sector saw a decline of three. Most declines were from the Flex commercial listings instead of the NETAR Commercial Multiple Listing Service (CMLS).

Although pessimistic headlines have become the new commercial real estate norm most of the focus is on conditions in major metro markets. At the same time opportunities are appearing in rural metro markets like the Tri-Cities region..

Last month’s 40 new listings boosted active inventory to its best level since June last year.

The local market finished 2023 with a 19.6% transactions decline which mirrors the national commercial real estate slump.

Here’s how the National Association of Realtors (NAR) Research Department assessed the primary local CRE sectors at the end of the fourth quarter and began moving into the new year.

RETAIL SPACE

This is the only sector where there is more local demand than there is nationwide in both local metro areas. The transaction sales price in the Johnson City metro is $179 per square foot up from $173 during Q4 2022. Vacancy rate is 1.3%. Market rent growth in the past 12 months was 4.7% at $16 per square foot.

Retail space transaction price per square foot in the Kingsport-Bristol metro area is $146, up from $131. The vacancy rate is 1.5%. Market rent growth during the past year was 4.6% at $13 per square foot.

MULTIFAMILY

Demand in the Johnson City metro area is stronger than it is nationwide. The vacancy rate dropped to 3.3% from 4.5% in Q4 2022. Effective rent per unit is $990, up from $950 for the metro area’s 7,413 multifamily units.

Kingsport-Bristol’s demand is weaker than is it nationwide and it has a slow absorption of space. The vacancy rate on the metro area’s 5,933 units is 5.6% down from 5.8%. The effective rent per unit is $1,050 per unit.

OFFICE

Office pace in the Johnson City metro is weaker than it is nationwide, and the three-county vacancy rate is 6.5% up from 1.9%. The market rent per square foot is $19 and the 12-month growth rate is 2%. Net absorption in the last 12 months is down 212,176 square feet.

Kingsport-Bristol has the opposite demand status, its stronger than it is nationwide. The vacancy rate is 4% down from 4.8%. The market rent per square foot is $19 and the 12-month rent growth is 1.9% compared to 5.8% during Q4 2022. Net absorption during the past 12 months is down 71,942.

INDUSTRIAL

Demand in both metro areas is weaker than it is nationwide. The Johnson City metro area vacancy rate is 1.9% and the market rent growth in the past 12 months is 8.4%. Market rent growth during the past 12 months is 8.4%, down from 11.8%. Market rent per square foot is $7 up from $5. Net absorption per square foot during the past 12 months is down 3,265.

In the four-county Kingsport-Bristol metro area, the vacancy rate is 4.4% and the market rent per square foot is $7, up from $5. Market rent growth during the past 12 months is 8%, down from 11.7%. Net absorption per square foot during the pervious 12 months is down 545,349.

Data source: NETAR sales and rent transactions. NAR analysis on data from the U.S. Census, Bureau of Labor Statistics, Bureau of Economic Analysis and Costar.

NETAR is the voice for real estate in Northeast Tennessee. It is the largest trade association in the Northeast Tennessee, Southwest Virginia region, representing over 1,800+ members and 100+ business partners involved in all aspects of the residential and commercial real estate industries. Weekly market reports and information for both consumers and members are available on the NETAR website at https://netar.us