Forbearance exit helps boost inventory

Don Fenley

The first wave of borrowers is exiting the forbearance program through October. They have the option to resume making mortgage payments, modify their loan, or cashing out at the top of a hot market. Some are opting for the latter option. It’s one of the things boosting inventory at the local and U.S. markets.

The sunset date for the program’s final extension is the first of next year, and the Biden Administration doesn’t plan another extension.

Although the precise number of local borrowers who have opted to cash out is not available, it’s likely one of the drivers behind the current uptick in new listings and active inventory.

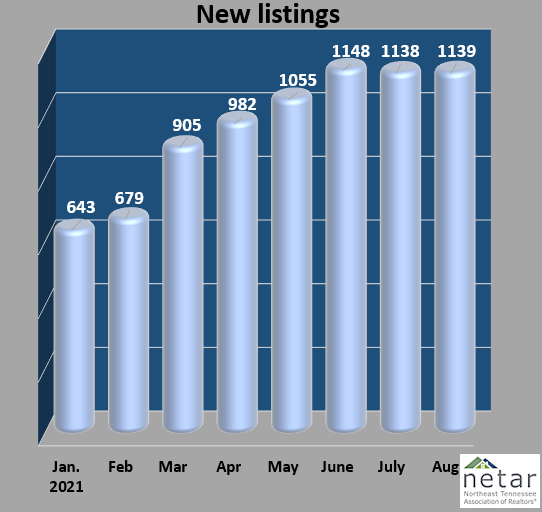

New listing made strong gains in March through May, then leveled off through August. It was up 3.4% over July last month. That’s still 25% lower than August last year, so although the gap is closing is moving at a snail’s pace.

Earlier this summer, a Fortune-Home LLC research project estimated that the end of the program would likely bump inventory by 11%. Applied locally, that would be about 150 extra new listings. As welcome as it would be, it’s not enough to move things back to balanced market conditions.

New residents moving to the area, a wave of Millennials, and the oldest of Gen. Z lining up to become homeowners and a decade of underbuilding ensure that demand will continue outmatching supply for at least a couple more years.

NETAR is the voice for real estate in Northeast Tennessee. It is the largest trade association in the Northeast Tennessee, Southwest Virginia region, representing over 1,800+ members and 100+ business partners involved in all aspects of the residential and commercial real estate industries. Weekly market reports and information for both consumers and members are available on the NETAR website at https://netar.us