March home sales up 36%, another double-digit price increase

Don Fenley

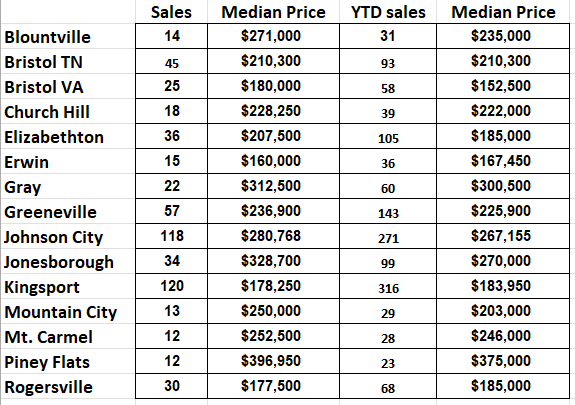

It’s a foregone conclusion that higher mortgage rates will eventually tap the brakes on the overheated housing market. But it hasn’t shown up on the short-term local market yet. March sales were up 36% from the previous month. Sellers accepted more contracts. Homes spent less time on the market. And there was another double-digit price increase.

“March’s monthly sales were a dramatic contrast to the yearly trend. The primary driver was rising mortgage rates. We’re in a dysfunctional situation where fundamentals that typically define the market are in opposition,” Rick Chantry, president of the Northeast Tennessee Association of Realtors (NETAR), said. Mortgage rates are toying with a 5% average. “At a 5% rate, home sales this year may even fall by 10%,” according to Dr. Lawrence Yun, chief economist at the National Association of Realtors (NAR). Yun thinks rates will continue increasing from April 4’s 4.72% average, but at a slower pace.

There were 792 closings as of April 4. That’s 226 more than there were in February, and the total will increase as closings that were not filed by the end of the month are included. “It’s a hefting increase, but down 7.9% from March last year,” Chantry added.

Last month’s average sales price of $266,385 is 16.5% higher than last year, while the typical – or median – sales price of $227,250 is 22.9% higher. And March’s sale-to-list ratio increased to 99.4%. That means most sales were at or slightly below the seller’s list price. However, that doesn’t mean all sales closed at the list price. Last month’s median sales price was $12,693 below the median list price.

Inventory continued dropping in March. As of the end of the month, the region had 0.9 months’ supply of homes for sale. Some city markets had half a month’s inventory. Balanced market conditions are five to six months of inventory. The local market hasn’t seen that since the first quarter of 2018.

The typical home sale that closed last month was on the market for 45 days, down from 59 days in February. The days on market count begins when a property is listed and ends on the day the sale closes.

Although mortgage rates are up, inventory is down, and prices are higher, some buyers are eager to lock in the best possible rate before the next weekly hike. That’s fanning the flames on an already overheated market.

NETAR is the voice for real estate in Northeast Tennessee. It is the largest trade association in the Northeast Tennessee, Southwest Virginia region, representing over 1,800+ members and 100+ business partners involved in all aspects of the residential and commercial real estate industries. Weekly market reports and information for both consumers and members are available on the NETAR website at https://netar.us