Market trend good news for first-time buyers

Don Fenley

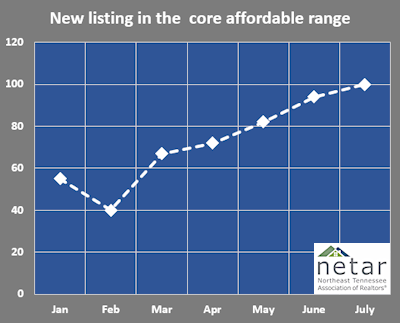

July’s housing trends had some good news for first-time buyers and those shopping in the affordability zone. Sellers added more homes in the $180,000 to $200,000 price range for the fifth straight month. So far this year, new listings in that price range are 30.8% higher than they were during the first seven months of last year.

That price range is called the affordability zone because the median existing-home sales price so far this year is $190,000. That’s the price where half of the sales were for more and half were for less. Year-to-date price appreciation for the median sales price is 16.9%. The average is 23.8%. It has been skewed higher due to the number of sales in the higher price ranges. Those higher sales volumes were driven by two primary factors. The first is out-of-state residents relocating here with the proceeds from sales of their homes in more expensive markets. The second is that record-low mortgage prices boosted buyers’ buying power, and many used it to buy more homes.

July’s housing trends show a market slowly working its way back to some version of normal. Months of inventory have ticked slightly higher. The time a home spends on the market before selling has also increased. New contract approvals are still more than last year, but the trend for this year is declining.

Buyers may not see much price moderation in the overall market. Still, more new and activity inventory in the affordable zone is a noteworthy dynamic for a transitioning market. Historically most homes sales in the local market have been in the $200,000 and below price ranges. They used to account for about 76% of all sales. Currently, they account for a little more than 40% of all sales.

NETAR is the voice for real estate in Northeast Tennessee. It is the largest trade association in the Northeast Tennessee, Southwest Virginia region, representing over 1,800+ members and 100+ business partners involved in all aspects of the residential and commercial real estate industries. Weekly market reports and information for both consumers and members are available on the NETAR website at https://netar.us