Mid-Year Housing Data Show Strong Regional, Submarket Growth

Kristi Bailey 2020 NETAR President

It safe to say we’ve just completed a half year like no other in the local real estate history. A look at some of the data from the Northeast Tennessee Association of REALTORS® (NETAR) mid-year update affirms that.

Here are some regional highlights:

- During the first six months of the year sales were up 21.3 percent on 4,575 closings.

- The average sales price of $231,475 rewarded sellers with $44,502 per sale more than the first six months of last year. That’s a 23.8 percent increase.

- The region had an average of 1.5 months of inventory for the period. That’s expected to increase as we move into the fall and winter buying and selling season. June was the first month since November last year that new listings outnumbered accepted contracts. Inventory is expected to remain tight for the rest of the year and into 2022.

- Homes were selling faster than ever. At mid-year, the typical house sold three weeks faster than it did last year.

A quick drill down on the local submarkets’ mid-year data offers a more compartmental measure of market performance. Here’s a couple of examples:

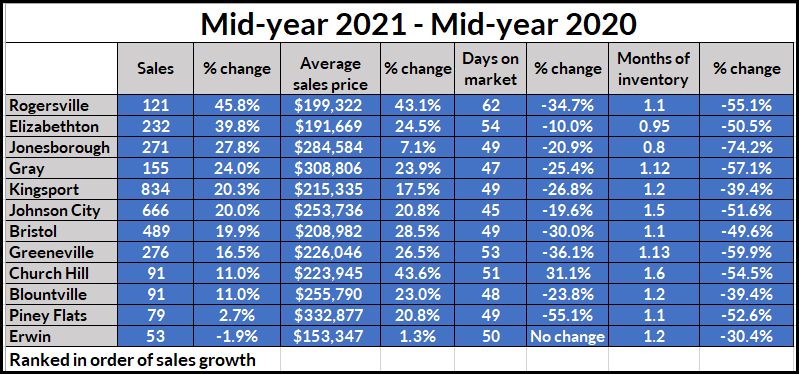

- Four markets outperformed the regional sales growth rate. They were Rogersville, Elizabethton, Jonesborough, and Gray.

- Seven submarkets had a sales price growth rate better than the regional growth rate. They included: Church Hill, Blountville, Rogersville, Bristol, Greeneville, Elizabethton, and Gray.

Beginning to notice a pattern?

The smaller markets continued a strong infill that began last year. All the signs point to more of the same through at least the first half of this year. One of their strongest headwinds will be the continued lack of inventory.

It looks like the days of sub 3 percent mortgage rates may be a thing of the past for the fall and winter seasons. The current projection is they will average 3.5 percent at year’s end. That’s still a substantial bargain when compared to the market’s historical average of 7.5 percent.

Tighter lending standards and limited inventory will continue to put upward pressure on prices. Still, it’s expected to be slightly less than what the first half of the year saw. The higher prices will continue to push some buyers out of the market. But that doesn’t mean the region is queued up for an affordability crisis. Average local workers can manage the major expenses of homeownership based on lender standards. But some markets have gone in the wrong direction as the housing market roars onward. Still, region-wide, a buyer with a good credit rating, a solid down payment, and no more than a 28 percent front-end debt to income ratio has the buying power needed for a median-priced home. The challenge is the availability of inventory in the affordable range.

An uptick in the number of owners who suspect that the market has or is near a peak will move to cash in and list their homes. That will provide some inventory relief. So, will the additions from new home builders as the price of lumber and materials moderates. That’s important because only two submarkets averaged 1.5 months of inventory during the first half of the year.

The mid-year regional and submarket drill-downs show the Tri-Cities region on track for another record growth year.

NETAR is the voice for real estate in Northeast Tennessee. It is the largest trade association in the Northeast Tennessee – Southwest Virginia region representing over 1,400 members and 100 affiliates involved in all aspects of the residential and commercial real estate industries. Pending sales, Trends Reports, and the regional market analytics can be found on the NETAR websites at https://netar.us/voice-real-estate-northeast-tennessee.

NETAR is the voice for real estate in Northeast Tennessee. It is the largest trade association in the Northeast Tennessee, Southwest Virginia region, representing over 1,800+ members and 100+ business partners involved in all aspects of the residential and commercial real estate industries. Weekly market reports and information for both consumers and members are available on the NETAR website at https://netar.us