Smaller housing submarkets on top first-quarter stats

Kristi Bailey 2020 NETAR President

Last year demanded a radical new normal for doing business in the housing market. REALTORS® adapted and became leaders for those new best practices. This year, they will do the same to stay abreast of the Tri-Cities area dynamic housing market.

While no one can precisely say what those challenges will be, the Northeast Tennessee Association of REALTORS® (NETAR) Q1 Home Sales Report is a testament to how the market performed compared to the same period last year.

Here are the regional highlights:

- During the first three months of the year, sales were up 22%.

- The average sales price of $220,411 was a 23.7% increase.

- The region had an average of 1.5 months of inventory for the first three of 2021.

- Homes were selling faster than ever. The first quarter average was 25 days less than last year.

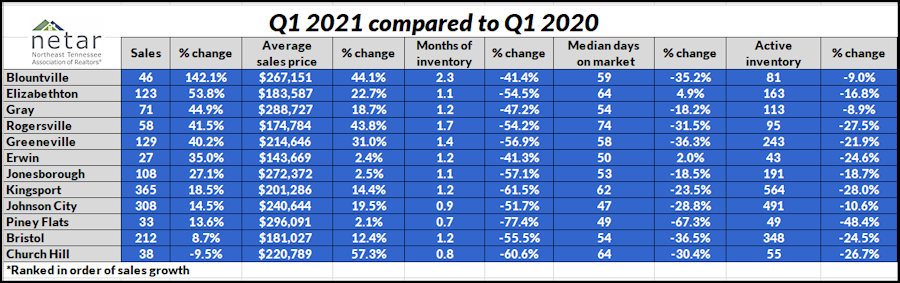

A quick drill down on the local submarkets’ performance offers some more precise measures of how the market is doing.

While the region saw strong sales growth and dramatic price appreciation, some submarkets dramatically outperformed the regional benchmark. Here are a few examples.

- Blountville’s sales growth was 6.5 times greater than the regional growth rate.

- Piney Flats’ average sales price of $296,091 was the highest in the region. The community also had the highest annual average price last year.

- Church Hill had the highest price growth rate. It was 33.6% higher than the region’s appreciation.

Beginning to notice a pattern?

The smaller submarkets are strong. All the signs point to more of the same through at least the first half of this year.

It looks like the days of sub 3% mortgage rates are over, and inventory is getting tighter. They will continue to put upward pressure on prices and higher prices will push some buyers out of the market. Some submarkets will be more affordable than others. Still, region-wide, a buyer with a good credit rating, a down payment, and no more than a 28% front-end debt to income ratio has the buying power needed for a median-priced home.

An uptick in the number of owners who have been holding back and now think it is time to make a move will provide some inventory relief. So will the additions from new home builders. Six of the 12 submarkets have less than a month’s worth of inventory. This group included Johnson City, Jonesborough, Elizabethton, Erwin, Church Hill, and Piney Flats.

National Association of REALTORS® (NAR) chief economist Lawrence Yun predicts U.S. home sales will increase 9% this year and prices will increase 3%.

The Q1 regional and submarket numbers show the Tri-Cities region on track for another growth year that will parallel or exceed the U.S. projection.

NETAR is the voice for real estate in Northeast Tennessee. It is the largest trade association in the Northeast Tennessee – Southwest Virginia region representing over 1,400 members and 100 affiliates involved in all aspects of the residential and commercial real estate industries. Pending sales, Trends Reports, and the regional market analytics can be found on the NETAR websites at https://netar.us/voice-real-estate-northeast-tennessee.

NETAR is the voice for real estate in Northeast Tennessee. It is the largest trade association in the Northeast Tennessee, Southwest Virginia region, representing over 1,800+ members and 100+ business partners involved in all aspects of the residential and commercial real estate industries. Weekly market reports and information for both consumers and members are available on the NETAR website at https://netar.us