Tri-Cities commercial real estate transactions struggle with COVID-19 economic fall out

Don Fenley

Tri-Cities commercial real estate (CRE) transactions continued laboring with the economic fallout of COVIX-19 in May. The short-term numbers are about what you would expect.

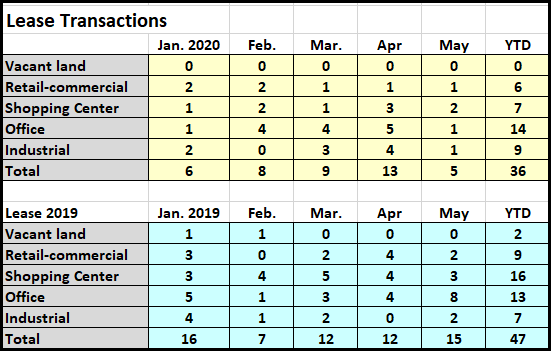

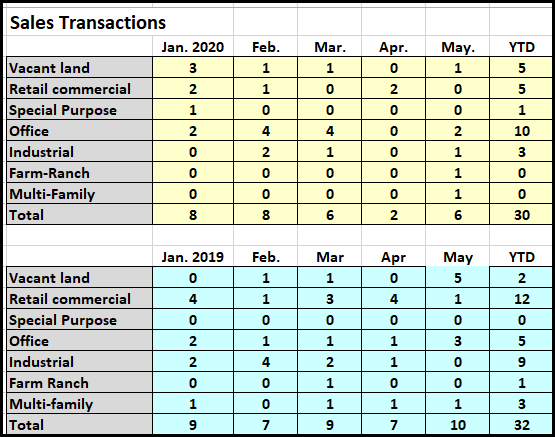

May sales were down 40% from last year while lease transactions were down 67%, according to the Northeast Tennessee Association of Realtors (NETAR) Commercial Multiple Listing Service (CMLS).

The longer-view is a little more encouraging. Year-to-date sales were 29% lower than the first five months of last year, and leases were down 29%.

Total transactions were down 32% from the first five months of last year.

But while transactions have slumped, listing traffic to local listings increased 17% from April. At the same time individual traffic and inquiries on listings has increased.

According to Deliotte Insights, “over the past century, external shocks such as an epidemic or a pandemic followed by an economic downturn have had an immediate to short-term impact on CRE asset prices, but minimal influence on transaction activity. However, the industry recovered from these events at varying paces: While event-oriented downturns showed a quicker rebound, longer-term events, such as the 2008 recession, resulted in a more protracted recovery. As a rule of thumb, the industry has historically lagged the broader economy by six months in terms of experiencing the effects. But the expansiveness, depth, and unprecedented reach of this pandemic has started impacting the CRE industry much sooner.”

As the listing traffic shows, there is increasing interest from investors who look past the headlines for opportunities. And there have been some noteworthy transactions – more about those when the deed transfers are completed, and the Appalachian Dashboard for Real Estate Analytics issues its mid-year report.

There were 547 listings at the end of May down from 586 in April.

Commercial space for sales in the Johnson City Metropolitan Statistical Area (MSA) 76,128 sq. feet. Down from 787,642 in April.

Commercial sales for lease totaled 487,295 sq. ft. down from 515,671 in April.

Commercial space for sales in the Kingsport-Bristol MSA was 1.3 million sq. ft. drown from 1.4 million in April.

Commercial space for lease was 435,821, down from 492,934 in April.

NETAR is the voice for real estate in Northeast Tennessee. It is the largest trade association in the Northeast Tennessee, Southwest Virginia region, representing over 1,800+ members and 100+ business partners involved in all aspects of the residential and commercial real estate industries. Weekly market reports and information for both consumers and members are available on the NETAR website at https://netar.us